Shop auto insurance Florida, and navigate the intricate world of policies tailored to Florida’s unique driving landscape. This comprehensive guide unveils the essentials of Florida auto insurance, from understanding the key legal requirements to comparing the offerings of leading insurance providers. Learn about various coverage options, discounts, and the claims process, empowering you to choose the perfect policy that balances affordability and adequate protection.

Florida’s auto insurance landscape presents a range of choices, from liability coverage to comprehensive policies. Understanding these options, along with the potential discounts and savings opportunities, allows you to make an informed decision. This guide will walk you through the crucial factors to consider when selecting the right insurance for your needs in Florida.

Overview of Florida Auto Insurance

Florida’s auto insurance landscape is characterized by specific legal requirements and a range of policy options tailored to diverse driver needs. Understanding these nuances is crucial for securing adequate coverage while minimizing costs.

Key Legal Requirements

Florida mandates minimum liability insurance coverage for all drivers. This typically includes bodily injury liability, covering medical expenses and lost wages for accident victims, and property damage liability, compensating for damage to another party’s vehicle. Failure to maintain these minimum requirements can result in penalties and legal ramifications.

Types of Auto Insurance Policies

Florida drivers can choose from various policy types, each offering varying levels of protection. Common types include liability-only policies, which meet the state minimum requirements; comprehensive policies, covering damages from events like vandalism or weather; and collision policies, covering damage to the insured vehicle in an accident, regardless of fault. Other options may include uninsured/underinsured motorist coverage, providing protection if involved in an accident with a driver lacking adequate insurance.

Costs and Factors Affecting Premiums

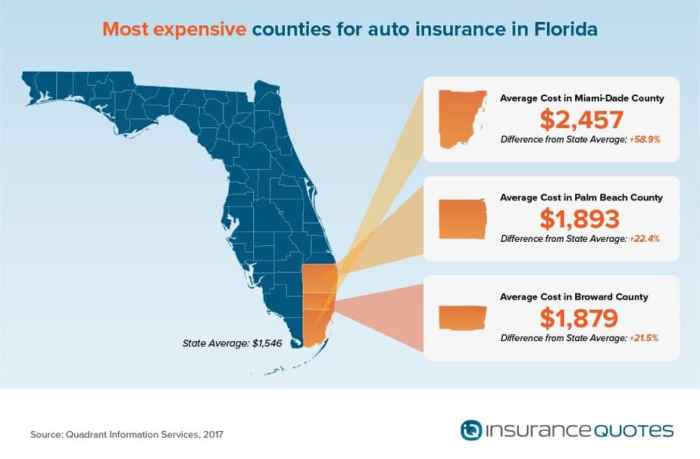

Source: insurancequotes.com

Auto insurance premiums in Florida are influenced by several factors. These include driving history (accident records, violations), vehicle type (age, make, model), location (high-risk areas may have higher premiums), and the chosen coverage level. Furthermore, discounts for safe driving practices, good student status, or certain vehicle features can lower premiums.

Typical Costs

Source: nrmafla.com

Average auto insurance premiums in Florida vary considerably depending on the aforementioned factors. While no single figure is definitive, research suggests premiums can range from a few hundred dollars annually for basic coverage to several hundred dollars for comprehensive policies. Factors like the driver’s age and credit history will also significantly influence the final cost.

Comparison of Florida Auto Insurance Providers

Florida boasts a competitive auto insurance market with numerous providers offering diverse packages. Choosing the right company requires careful consideration of coverage options, financial stability, and customer service reputation.

Coverage Options and Financial Stability

Major insurance providers in Florida offer a spectrum of coverage options. Factors like financial strength ratings, as assessed by independent agencies, and claims handling procedures are important considerations. Reputable companies typically demonstrate a strong track record of fulfilling claims promptly and fairly.

Comparative Analysis, Shop auto insurance florida

| Insurance Company | Average Premium (Estimated) | Discounts Offered | Customer Service Rating (Estimated) |

|---|---|---|---|

| Company A | $1,200 | Safe Driver, Good Student, Multi-Policy | 4.5 stars |

| Company B | $1,500 | Bundled Insurance, Anti-theft Device | 4.2 stars |

| Company C | $1,000 | Military Discount, Accident Forgiveness | 4.7 stars |

Note: Premiums and ratings are estimates and may vary based on individual circumstances.

Specific Coverage Options in Florida: Shop Auto Insurance Florida

Understanding the different types of auto insurance coverage is vital for selecting a policy that meets individual needs. Liability, collision, and comprehensive coverage are fundamental, while additional options can provide extra protection.

Coverage Types and Implications

Source: tgafl.com

Liability coverage protects against damages incurred by others in an accident. Collision coverage covers damage to the insured vehicle regardless of fault. Comprehensive coverage protects against events not involving collisions, like vandalism or weather damage. Uninsured/underinsured motorist coverage is essential for accidents involving drivers lacking sufficient insurance.

Examples of Coverage Use

Liability coverage is crucial in cases where the insured driver is at fault. Collision coverage is necessary if the insured vehicle is damaged in an accident, regardless of who is at fault. Comprehensive coverage is useful for incidents like hail damage or theft. Uninsured/underinsured motorist coverage provides protection if the at-fault driver has insufficient insurance to cover the damages.

Navigating the complexities of shop auto insurance Florida can feel like a journey of the soul, a quest for the perfect alignment between protection and peace of mind. Scrutinizing options, like considering if Lemonade home insurance is truly legitimate, is lemonade home insurance legit helps illuminate the path toward a harmonious insurance solution. Ultimately, the right auto insurance in Florida is a beacon, guiding you toward a state of financial and emotional equilibrium.

Coverage Options Table

| Coverage Type | Description | Typical Cost (Estimated) | Potential Risks |

|---|---|---|---|

| Liability | Covers damage to others | $200-$500 annually | Limited protection for insured driver |

| Collision | Covers damage to insured vehicle | $100-$300 annually | May not cover all damage types |

| Comprehensive | Covers non-collision damages | $50-$150 annually | Exclusions for certain events |

Last Word

In conclusion, navigating Florida’s auto insurance market requires careful consideration of various factors, including policy types, provider comparisons, and available discounts. This guide has provided a comprehensive overview of the process, from understanding the legal requirements to choosing the right coverage options and navigating the claims process. Armed with this knowledge, you can confidently shop auto insurance Florida, finding a policy that meets your specific needs and budget.