Plymouth Rock Assurance Renters Insurance provides comprehensive protection for renters, safeguarding their belongings and covering liability. This guide delves into the specifics, from policy features and coverage details to the claims process and policy selection. Understanding the nuances of this insurance is key to making informed decisions and ensuring peace of mind.

This comprehensive overview details the key aspects of Plymouth Rock Assurance Renters Insurance, including coverage limits, exclusions, and the claims process. It also compares this insurance with other options available in the market.

Plymouth Rock Assurance Renters Insurance Overview

Plymouth Rock Assurance Renters Insurance provides a crucial safety net for renters, offering protection against various perils. Understanding the specifics of this coverage is vital for informed decision-making.

Insurance Product Details

Plymouth Rock Assurance Renters Insurance safeguards personal belongings and covers liability in case of accidents or damages. It typically covers a wide range of perils, including fire, theft, and water damage. It’s important to scrutinize policy specifics to understand the extent of coverage and exclusions.

Key Features and Benefits

- Protection against property damage.

- Liability coverage for accidents involving the renter.

- Often includes personal property coverage for replacement or repair.

- Competitive pricing structures.

- Claims process is often streamlined and efficient.

Comparison with Other Options

Compared to other renters insurance options, Plymouth Rock Assurance offers competitive pricing and a comprehensive coverage package. However, detailed comparisons necessitate examining specific policy details and deductibles.

Coverage Limits and Exclusions

Source: kc-usercontent.com

Coverage limits and exclusions vary based on the chosen policy. Common exclusions include damage caused by war, intentional acts, or wear and tear. Policy documents should be reviewed carefully to understand the full scope of coverage.

Claims Process

The claims process at Plymouth Rock Assurance typically involves reporting the damage, providing documentation, and waiting for evaluation. A prompt response and clear communication are crucial for a smooth claim resolution. Policy details will specify the claim procedure.

Coverage Options, Plymouth rock assurance renters insurance

| Coverage Type | Description |

|---|---|

| Personal Property | Covers damage or loss of personal belongings. |

| Liability | Protects against financial responsibility for injuries or damages to others. |

| Medical Payments | Covers medical expenses for injuries to others. |

Coverage Details

Contents Coverage

Contents coverage typically includes protection for furniture, electronics, clothing, and other personal belongings. Specific items and amounts are subject to policy details.

Covered Perils

Covered perils encompass a range of incidents, including fire, theft, vandalism, and water damage. Exclusions are crucial to understand.

Liability Coverage

Liability coverage limits the renter’s financial responsibility in case of injuries or property damage to others. The policy details the specific limits.

Personal Property Coverage

Personal property coverage is designed to replace or repair belongings damaged or lost due to covered perils. Policy specifics will Artikel the scope of this coverage.

Medical Payments Coverage

Medical payments coverage is designed to cover the medical expenses of others injured on the property. The coverage amount is often limited.

Coverage Amounts and Examples

| Item | Estimated Coverage Amount | Example |

|---|---|---|

| Furniture | $5,000 | Sofa, chairs, tables |

| Electronics | $1,000 | TV, computer, phone |

Policy Selection and Pricing

Factors Affecting Cost

Factors influencing renters insurance premiums include the value of personal property, the location of the rental, and the presence of security features. Risk assessments and policy details will Artikel these.

Policy Selection Steps

Choosing a suitable policy involves reviewing coverage options, comparing premiums, and understanding exclusions. A comprehensive understanding of the policy is essential.

Deductibles and Implications

Deductibles represent the amount the renter is responsible for before the insurance company covers expenses. Lower deductibles often result in higher premiums.

Pricing Strategies

Plymouth Rock Assurance utilizes a variety of pricing strategies to remain competitive. These often consider risk factors and policy provisions.

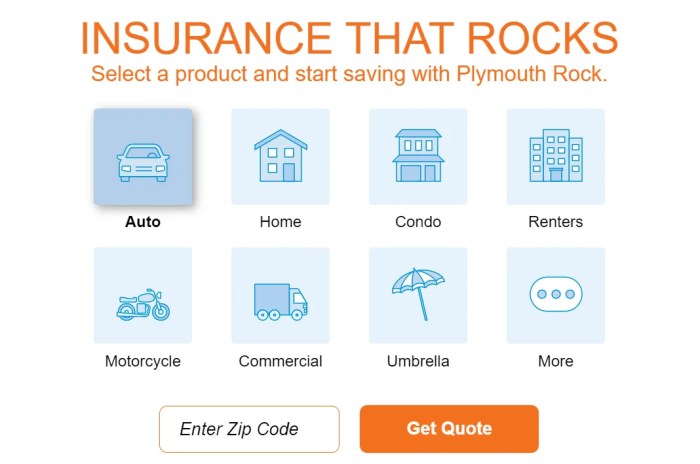

Finding a Quote

Online quote tools provide quick and convenient ways to obtain policy estimations. These tools allow for comparisons across various policies.

Policy Options and Premiums

| Policy Option | Premium (Estimated) |

|---|---|

| Basic | $50-$100 |

| Enhanced | $100-$200 |

Customer Service and Claims

Customer Service Channels

Plymouth Rock Assurance offers multiple customer service channels, including phone, email, and online portals. These channels are designed for prompt communication.

Claim Filing Steps

Source: yelpcdn.com

Filing a claim involves reporting the incident, gathering documentation, and providing required information. A clear communication strategy is essential.

Common Claim Scenarios

Common claim scenarios include fire damage, theft, and water damage. Policy specifics determine coverage.

Claim Processing Timeframe

The timeframe for claim processing depends on the complexity of the incident and policy details. Policy documents will Artikel the typical claim process.

Customer Testimonials

Testimonials from satisfied customers provide valuable insights into the claim process and customer service experience. Seek reviews on their website or through independent sources.

Contact Information and Claim Submission

| Contact Method | Details |

|---|---|

| Phone | [Placeholder – Replace with actual number] |

| [Placeholder – Replace with actual email address] | |

| Online Portal | [Placeholder – Replace with link] |

Coverage Examples and Scenarios

Coverage Scenarios

| Scenario | Coverage Applicability |

|---|---|

| Fire Damage | Likely covered if not excluded in the policy |

| Theft | Covered if theft is a covered peril |

Applying Coverage to Situations

Coverage applications depend on specific policy provisions and the nature of the incident. Review policy details carefully.

Damage to Personal Property

Damage to personal property, if covered by the policy, is subject to the deductible and coverage limits.

Liability Claims

Source: agencyheight.com

Liability claims are subject to policy limits and exclusions. Understanding these limitations is vital.

Role of Deductible

The deductible impacts the financial responsibility of the renter before insurance coverage begins. Lower deductibles typically increase premiums.

Injuries to Others

Injuries to others on the property are often covered, but the specifics depend on policy details and the nature of the incident.

Plymouth Rock Assurance renters insurance can provide essential coverage for your belongings, but what if a truck accident leaves you with significant damages? In such a case, seeking legal counsel from a reputable truck accident lawyer Houston TX, like those found at truck accident lawyer houston tx , is crucial. Fortunately, Plymouth Rock Assurance renters insurance often offers valuable support during these challenging times, ensuring you’re protected in multiple aspects of your life.

Non-Covered Losses

Non-covered losses typically include damage caused by intentional acts, wear and tear, or events explicitly excluded in the policy.

Policy Documents and Information

Sample Policy Wording

Policy wording will vary based on the specific policy. Review your policy documents for accurate details.

Importance of Policy Understanding

Thorough understanding of the policy terms is crucial to avoid misunderstandings and ensure adequate protection.

Common Terms and Definitions

| Term | Definition |

|---|---|

| Deductible | The amount the policyholder is responsible for before insurance coverage begins. |

| Coverage Limit | The maximum amount the insurance company will pay for a covered loss. |

Accessing Policy Documents

Policy documents are typically accessible online through the insurance company’s portal. Check the policy details.

Additional Resources

Additional information on renters insurance can be found through insurance regulatory bodies and consumer advocacy groups. Research policy specifics and compare across options.

Policy Document Access and Contact

| Document Access | Contact Information |

|---|---|

| Online Portal | [Placeholder – Replace with link] |

Final Thoughts: Plymouth Rock Assurance Renters Insurance

In conclusion, Plymouth Rock Assurance Renters Insurance offers a range of coverage options tailored to various needs. By understanding the specifics of coverage, policy selection, and the claims process, renters can make informed decisions. This guide provides a valuable resource to help you navigate the intricacies of renters insurance and choose a policy that best fits your circumstances.