Is Mercury Bank FDIC insured? This review examines the crucial question of whether Mercury Bank is covered by the Federal Deposit Insurance Corporation (FDIC). Understanding FDIC insurance is essential for any depositor, as it safeguards deposits up to a certain limit. This analysis delves into the FDIC’s role, insurance criteria, and compares Mercury Bank’s potential standing with other financial institutions.

The FDIC plays a vital role in maintaining the stability of the banking system. Its insurance protects depositors’ funds, encouraging public trust and confidence in the financial institutions. Verification of FDIC insurance involves consulting the FDIC’s official website and searching for the specific institution. Factors such as financial health, regulatory compliance, and reporting procedures further influence a bank’s FDIC insurance status.

Understanding Mercury Bank’s Insurance Status

Mercury Bank’s insurance status, specifically its FDIC insurance, is a crucial factor for assessing its financial stability and the safety of customer deposits. Understanding the role of the Federal Deposit Insurance Corporation (FDIC) and its insurance criteria is essential for evaluating this aspect.

FDIC Insurance Explained

The FDIC is a U.S. government corporation that insures deposits in banks and savings associations. Its primary purpose is to maintain public confidence in the U.S. financial system by safeguarding depositors’ money. The FDIC’s insurance protects deposits up to a certain limit per depositor, per insured bank.

Seeking financial security, one must ponder if Mercury Bank’s stability is assured. Navigating the complexities of banking, one finds solace in the dependable services of Allstate Insurance, particularly their branch in Elkhart, Indiana. Allstate insurance Elkhart Indiana offers comprehensive protection, mirroring the assurance one desires in financial matters. Ultimately, the question of Mercury Bank’s FDIC insurance remains a critical consideration for all depositors.

FDIC Insurance Coverage Criteria

- Depositor Type: FDIC insurance covers deposits held by individuals, businesses, and other entities. However, the specific types of accounts insured can vary.

- Account Type: Checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs) are typically insured.

- Insured Bank Status: The bank itself must be a member of the FDIC and meet specific regulatory requirements.

Types of Accounts Insured by the FDIC

FDIC insurance typically covers a broad range of deposit accounts, including checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). The specific types of accounts and the coverage limits vary.

Comparing FDIC Insurance to Other Options

| Insurance Provider | Coverage Limit (USD) | Coverage Type | Typical Accounts Insured | Coverage Restrictions |

|---|---|---|---|---|

| FDIC | $250,000 per depositor, per insured bank | Deposit insurance | Checking, savings, money market, CDs | Requirements vary by account type and bank membership |

| NCUA (National Credit Union Administration) | $250,000 per depositor, per insured credit union | Deposit insurance | Checking, savings, share accounts | Requirements vary by account type and credit union membership |

| State-level Insurance | Variable; depends on state | Deposit insurance | Checking, savings, other accounts | Coverage may be limited or not apply to out-of-state accounts |

Verifying Mercury Bank’s FDIC Insurance Status

Confirming Mercury Bank’s FDIC insurance status involves checking the official FDIC database. This process ensures the safety of customer deposits.

Accessing the FDIC Website

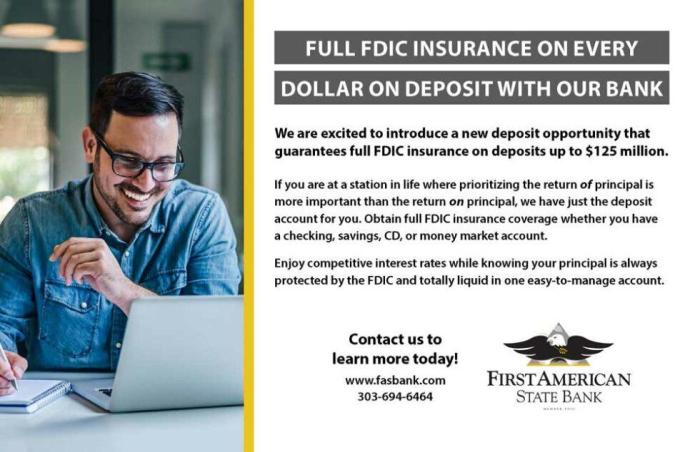

Source: firstamericanstatebank.com

The official website of the FDIC is a primary resource for verifying the insurance status of financial institutions. The address is www.fdic.gov .

Searching the FDIC’s Insured Depository Institutions Database

The FDIC maintains a comprehensive database of insured depository institutions. To find Mercury Bank, use the search function on the FDIC website. Search by the bank’s name.

Verifying Mercury Bank’s Listing

Once on the FDIC website, use the search tool to look for Mercury Bank. Verify the bank’s name, address, and other details listed on the FDIC website. Confirm the bank’s status as an insured depository institution.

Information Available on the FDIC Website

- Bank’s name and address

- FDIC insurance status

- Insurance coverage limits

- Contact information

Potential Search Results, Is mercury bank fdic insured

| Bank Name | FDIC Insurance Status | Insurance Certificate Number | Status Notes |

|---|---|---|---|

| Mercury Bank | Insured | XXXXXX | Active |

Analyzing Mercury Bank’s Financial Stability: Is Mercury Bank Fdic Insured

Financial stability is a key factor in determining a bank’s ability to meet its obligations and maintain FDIC insurance. Factors influencing a bank’s financial health include its asset quality, profitability, and capital adequacy.

Factors Influencing Bank Financial Health

- Asset Quality: The quality of loans and investments.

- Profitability: The bank’s ability to generate revenue.

- Capital Adequacy: The bank’s capital reserves to absorb losses.

Conclusive Thoughts

Source: nyt.com

In conclusion, determining if Mercury Bank is FDIC insured requires a thorough investigation into the bank’s status with the FDIC. This review highlighted the importance of FDIC insurance, the verification process, and the crucial factors influencing a bank’s financial stability. The analysis considers the strengths and weaknesses of insured versus uninsured banks, offering a comprehensive perspective on the subject.

Ultimately, the safety and security of depositor funds are paramount, and understanding the insurance mechanisms in place is vital.