Home and auto insurance quotes Texas: Navigating the Texas insurance market can feel overwhelming. Understanding the factors impacting your premiums and comparing various providers is crucial for securing the best possible coverage. This guide provides a comprehensive overview of the process, from understanding the market landscape to securing affordable quotes and grasping coverage details.

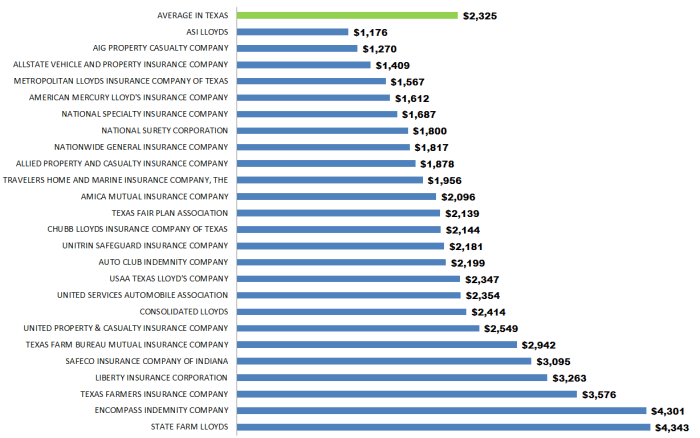

Texas has a diverse insurance market, with various providers offering different strengths and weaknesses. Premiums depend on several key factors, including your location, home value, credit score, and driving record. Comparing quotes from multiple providers is essential for finding the most suitable coverage at a competitive price. This guide explores the critical factors affecting your insurance needs and presents valuable tools to assist in your decision-making process.

Overview of Texas Home and Auto Insurance

Texas’s home and auto insurance market is a complex landscape shaped by various factors, including geographic location, population density, and economic conditions. Understanding the nuances of this market is crucial for anyone looking to secure affordable and comprehensive coverage.

Current Market Trends and Challenges

The Texas market is characterized by fluctuating premiums, influenced by increasing claims frequency, particularly for auto accidents. Rising construction costs are impacting home insurance, while a competitive landscape of insurers necessitates careful comparison shopping. Natural disasters, such as severe storms and flooding, pose a significant risk, especially in certain regions of the state.

Factors Influencing Premiums

Several key factors contribute to the cost of insurance in Texas. Location plays a critical role, with areas prone to natural disasters or high-accident zones commanding higher premiums. Coverage choices, such as comprehensive versus liability, directly affect the final cost. Risk factors, including a driver’s history and a home’s vulnerability to damage, significantly impact the quoted price.

Your credit score can also influence your auto insurance rate.

Looking for home and auto insurance quotes in Texas? Finding the right deal can be a total pain, right? But hey, checking out reviews for local agencies like Sapp Insurance Agency, which is part of Allstate Insurance in Baytown, might help. Sapp Insurance Agency Allstate Insurance Baytown reviews can give you a good idea of what other people think.

Ultimately, comparing different quotes from various providers is still key for the best deal in Texas.

Types of Home and Auto Insurance

Texas offers a variety of insurance options for both homeowners and drivers. Common types include liability, collision, comprehensive, and uninsured/underinsured motorist coverage for auto, and dwelling, liability, and additional living expenses coverage for home insurance. Understanding the specific coverage options and exclusions is vital to ensure adequate protection.

Insurance Provider Comparison

| Provider | Strengths | Weaknesses | Customer Reviews |

|---|---|---|---|

| Example Provider 1 | Excellent customer service, responsive claims handling. | Slightly higher premiums compared to competitors. | Positive, emphasizing prompt service and claim resolution. |

| Example Provider 2 | Competitive pricing, wide range of policy options. | Limited coverage options in some areas, potentially slower claim processing. | Mixed, some positive feedback on pricing, some negative feedback on service. |

Factors Affecting Quotes

Various factors significantly impact the price of home and auto insurance in Texas. Understanding these factors is essential to securing the best possible rates.

Impact of Coverage Levels

Higher coverage levels generally translate to higher premiums. Comprehensive coverage, including protection against perils like vandalism and weather events, usually costs more than liability-only coverage. Choosing the right coverage balance for your specific needs is key.

Role of Deductibles

Deductibles represent the amount you pay out-of-pocket before the insurance company steps in. Lower deductibles lead to higher premiums, while higher deductibles result in lower premiums. Balancing affordability with sufficient protection is crucial.

Impact of Factors on Home and Auto Quotes, Home and auto insurance quotes texas

Source: cloudinary.com

The factors affecting home insurance premiums are primarily based on the home’s characteristics and location. For auto insurance, driver history and vehicle type are key considerations. Location impacts both, as mentioned above.

Factors Influencing Home Insurance Premiums

| Factor | Description | Impact on Premium |

|---|---|---|

| Home Value | Market value of the property | Higher value, higher premium |

| Location | Proximity to fire hazards, natural disasters | Higher risk, higher premium |

| Home Features | Security systems, fire safety features | Enhanced safety, potentially lower premium |

Insurance Provider Comparison (Continued)

A comprehensive comparison of insurance providers is necessary to make informed decisions. Understanding specific policy offerings and customer satisfaction levels is crucial.

Coverage Options Comparison

| Policy | Coverage A | Coverage B | Coverage C |

|---|---|---|---|

| Example Policy 1 | Property damage | Liability | Personal injury |

| Example Policy 2 | Dwelling coverage | Additional living expenses | Personal liability |

Finding Affordable Quotes: Home And Auto Insurance Quotes Texas

Obtaining competitive quotes is a vital step in securing affordable insurance. Leveraging comparison tools and discounts can significantly reduce costs.

Online Quote Comparison Tools

Source: churchreaders.com

- Example Quote Tool 1

- Example Quote Tool 2

- Example Quote Tool 3

Understanding Coverage Options (Continued)

Source: texasquotes.com

Understanding the various coverage options is crucial for securing adequate protection. Recognizing policy exclusions and endorsements is essential to avoiding gaps in coverage.

Common Coverage Options

| Coverage | Description | Example Scenarios |

|---|---|---|

| Comprehensive Coverage (Auto) | Covers damage from perils not covered by collision (e.g., vandalism, theft, weather damage) | Vandalism, theft, hail damage, fire damage |

Claims Process and Procedures

Navigating the claims process efficiently is important for a smooth resolution. Understanding the steps involved in filing a claim is vital.

Claim Filing Process

Filing a claim involves notifying the insurance company, providing documentation, and cooperating with adjusters. Timeframes for claim settlements vary based on the complexity of the claim.

Last Point

In conclusion, securing the right home and auto insurance quotes in Texas involves understanding the market, assessing your needs, and comparing various options. This guide has illuminated the key factors influencing premiums, highlighted popular providers, and presented methods for obtaining affordable quotes. Remember to carefully review coverage details and understand policy exclusions before making a commitment. By diligently following the steps Artikeld in this guide, you can confidently navigate the Texas insurance market and protect your assets with suitable coverage.