Does Allstate have good homeowners insurance? A question that echoes through the shadowed halls of financial anxieties, a whispered plea in the face of unforeseen storms. The weight of protecting one’s home, one’s life’s work, rests heavily on the shoulders of the insured, a burden made more complex by the myriad options and often-conflicting reviews.

This exploration delves into the specifics of Allstate’s homeowners insurance, examining coverage options, customer feedback, claims processes, premium factors, and exclusions. We will also compare Allstate to alternative providers, offering a comprehensive overview to aid in the crucial decision-making process. The labyrinthine world of insurance is often a place of apprehension, but understanding the intricacies can offer a measure of solace.

Allstate Homeowners Insurance Overview

Allstate Homeowners Insurance provides comprehensive coverage for homeowners, protecting their property and assets against various risks. Understanding the specific types of coverage and how they compare to other insurers is crucial for making informed decisions.

Coverage Details

Allstate offers a range of coverages, including dwelling coverage for the structure of the home, personal property coverage for belongings within the home, and liability coverage for incidents that may cause harm to others. The specific details and limits of each coverage type vary based on the chosen policy.

- Dwelling Coverage: Protects the physical structure of the home from damage caused by perils like fire, windstorms, and hail.

- Personal Property Coverage: Covers personal belongings within the home, including furniture, electronics, and clothing, against loss or damage from various events.

- Liability Coverage: Protects the policyholder from financial responsibility if someone is injured or their property is damaged due to an incident on their property.

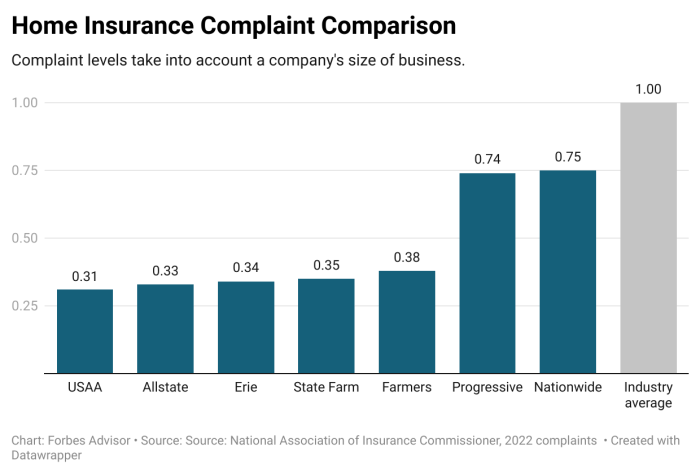

Comparison to Other Insurers

Source: forbes.com

Allstate’s coverage options generally compare favorably to other major insurers. However, policy specifics and premium costs can vary, requiring careful review of individual policy terms.

It’s recommended to compare Allstate’s policies with those of other leading insurers, considering factors like coverage limits, deductibles, and specific perils included or excluded. This comparison should involve reviewing the fine print of each policy and evaluating which best suits individual needs and circumstances.

While Allstate’s homeowners insurance policies are generally competitive, assessing whether it’s a good fit depends on individual needs. For instance, if you’ve been involved in a recent auto accident, particularly in Pueblo, you might need legal guidance from a pueblo auto accident lawyer. Ultimately, comparing Allstate’s coverage to other options is crucial to determine the best homeowners insurance for your situation.

Premium Comparison

Source: forbes.com

| Policy Type | Allstate Premium (Estimated) | Competitor A Premium (Estimated) | Competitor B Premium (Estimated) |

|---|---|---|---|

| Basic | $1,200 | $1,150 | $1,300 |

| Enhanced | $1,500 | $1,400 | $1,600 |

| Deluxe | $1,800 | $1,750 | $1,900 |

Note: Premiums are estimated and can vary based on individual circumstances. These are illustrative examples, and actual premiums should be obtained directly from the insurance providers.

Allstate Homeowners Insurance Customer Reviews and Ratings: Does Allstate Have Good Homeowners Insurance

Customer reviews and ratings offer valuable insights into the Allstate Homeowners Insurance experience. Analyzing both positive and negative feedback helps assess the overall satisfaction level.

Customer Feedback Summary

Generally, customer feedback regarding Allstate varies. Positive reviews often praise the ease of online claim filing and responsive customer service representatives. Conversely, some customers express concerns about high premiums or slow claim processing times. It’s essential to consider these contrasting viewpoints when evaluating Allstate.

Comparison with Competitors

Source: futurecdn.net

Comparing Allstate’s customer satisfaction ratings with competitors reveals a mixed picture. While Allstate may hold a competitive position in some areas, other insurers might excel in specific aspects, such as claim processing speed or affordability.

Customer Satisfaction Ratings, Does allstate have good homeowners insurance

| Policy Type | Allstate Customer Satisfaction Rating (Estimated) | Competitor A Customer Satisfaction Rating (Estimated) | Competitor B Customer Satisfaction Rating (Estimated) |

|---|---|---|---|

| Basic | 3.8/5 | 4.0/5 | 3.7/5 |

| Enhanced | 3.7/5 | 3.9/5 | 3.8/5 |

| Deluxe | 3.6/5 | 3.8/5 | 3.7/5 |

Note: Ratings are estimated and may vary based on the source and methodology.

Last Recap

Ultimately, the question of whether Allstate provides “good” homeowners insurance is deeply personal, contingent upon individual needs and circumstances. The nuances of coverage, the experiences of other policyholders, and the financial implications all play a role. Weighing the pros and cons, considering alternative options, and carefully evaluating the finer points of each policy will ultimately lead to an informed decision, one that, hopefully, brings a sense of security and peace of mind.

The choice, as with most significant life decisions, remains with the individual, a solitary path navigated through the complexities of the insurance landscape.