Car insurance quotes in Utah are crucial for responsible drivers. Navigating the diverse landscape of insurance providers and policies can feel overwhelming, but this comprehensive guide demystifies the process. From understanding the different types of coverage available to comparing pricing strategies, we’ll equip you with the knowledge to find the best car insurance deal in Utah.

Uncover the secrets to securing competitive quotes. Learn how your driving history, vehicle type, and location all play a role in shaping your insurance premiums. We’ll unveil strategies for finding multiple quotes and understanding policy details before making a commitment. Discover the key factors influencing car insurance costs in Utah and gain insights into saving money on your car insurance in the Beehive State.

Overview of Utah Car Insurance

Source: cloudinary.com

Utah’s car insurance landscape is shaped by state regulations and market forces. Understanding the types of coverage available and the factors that influence premiums is crucial for securing affordable and adequate protection.

Types of Car Insurance in Utah

Utah drivers can choose from various types of car insurance, including:

- Liability Insurance: This covers damages you cause to other people’s property or injuries to other people in an accident where you are at fault. It is the minimum required coverage in Utah.

- Collision Insurance: This pays for damages to your vehicle regardless of who is at fault in an accident. It protects your investment in your car.

- Comprehensive Insurance: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or weather-related incidents. It’s an important aspect of protecting your vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage is crucial in Utah, as it protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance or is uninsured. It’s vital for ensuring financial protection in such circumstances.

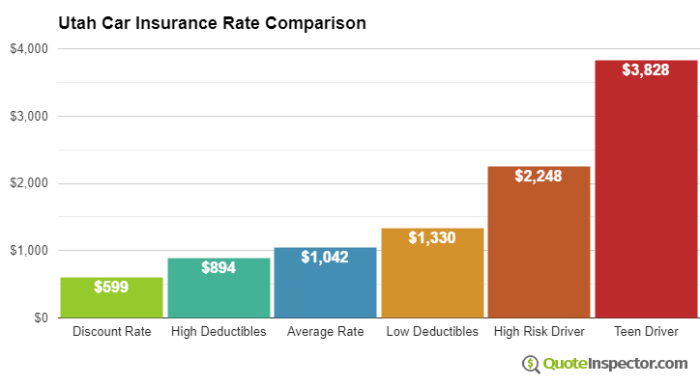

Factors Influencing Car Insurance Premiums in Utah

Several factors contribute to the cost of car insurance in Utah. These factors influence your premium and should be considered:

- Driving Record: A clean driving record with no accidents or violations usually leads to lower premiums. Accidents and traffic violations significantly increase premiums.

- Vehicle Type and Age: The type and age of your vehicle can affect your insurance rate. High-performance vehicles or older vehicles might have higher premiums compared to standard models.

- Location: Your location in Utah can affect your insurance rates. Areas with higher accident rates or crime might have higher premiums.

- Claims History: A history of making claims can impact your future premiums, increasing the cost.

Minimum Requirements for Car Insurance in Utah, Car insurance quotes in utah

| Coverage | Minimum Requirement |

|---|---|

| Liability Bodily Injury | $25,000 per person, $50,000 per accident |

| Liability Property Damage | $25,000 per accident |

Factors Affecting Car Insurance Quotes

Understanding the factors that influence car insurance quotes is essential for getting the best possible rates.

Seeking car insurance quotes in Utah? Understanding your options is key. For a broader perspective, exploring home and auto insurance quotes in Texas can provide valuable insights. home and auto insurance quotes texas can help you compare different policies. Ultimately, comparing various quotes in Utah will help you find the best fit for your needs.

Driving History

Your driving record is a primary factor in determining your insurance premiums. A clean record with no accidents or violations generally results in lower premiums. Conversely, accidents and violations increase your premium substantially.

Vehicle Type and Age

Source: quoteinspector.com

The type and age of your vehicle significantly impact your car insurance quote. High-performance vehicles or older, more valuable vehicles tend to have higher premiums due to increased risk of damage or theft.

Location

Geographic location plays a role in car insurance costs. Areas with higher accident rates or crime rates often have higher premiums due to the increased risk of claims.

Claims History

A history of making claims impacts future premiums, often leading to increased costs. The number and severity of claims influence your insurance rate.

Discounts Available

| Discount | Description |

|---|---|

| Safe Driver Discount | For drivers with a clean driving record |

| Multi-Policy Discount | For insuring multiple vehicles or other policies with the same company |

| Student Discount | For students who meet specific criteria |

| Defensive Driving Course Discount | For completing a defensive driving course |

Comparing Insurance Providers in Utah: Car Insurance Quotes In Utah

Utah has several insurance providers offering car insurance. Comparing their pricing, customer service, and financial stability is vital to choosing the right company.

Closing Notes

In conclusion, securing the right car insurance quotes in Utah empowers you to protect your vehicle and financial well-being. This guide has equipped you with the knowledge to confidently navigate the world of insurance providers and policies. From comparing coverage options to understanding cost-effective strategies, you’re now better prepared to make an informed decision. Drive confidently knowing you have the perfect car insurance policy tailored to your specific needs in the beautiful state of Utah.