Allstate dropping homeowners insurance casts a long shadow across the landscape of American homeownership. Whispers of financial strain and strategic shifts are swirling, leaving homeowners wondering about the future of their coverage. What forces are conspiring to reshape the insurance market? What alternatives will emerge to fill the void? This exploration delves into the potential reasons behind this decision, the impact on customers, and the wider implications for the insurance industry.

The potential reasons behind Allstate’s withdrawal are multifaceted and complex. Rising claim costs due to increasing natural disasters and wear and tear on aging infrastructure could be a major factor. Changing market conditions, perhaps influenced by new regulations or the emergence of competitive alternatives, could also play a role. A deeper dive into the company’s financial reports and recent statements will be crucial to unravel the enigma.

Allstate’s Homeowners Insurance Drop: A Deep Dive: Allstate Dropping Homeowners Insurance

Allstate’s potential withdrawal from the homeowners insurance market in certain regions is a significant development, raising concerns about the future of insurance accessibility and affordability. This article delves into the potential reasons behind this move, its impact on customers, financial implications, and the broader market trends influencing this decision.

Reasons for Allstate Homeowners Insurance Drop

Several factors could contribute to Allstate’s decision to reduce or discontinue its homeowners insurance offerings in specific areas. Rising claim costs, evolving market conditions, and strategic shifts within the company are key considerations.

Wah, Allstate ninggalin asuransi rumah, bikin kepala pusing nih! Mungkin mendingan cari alternatif yang lain, kayak shop car insurance florida buat mobil. Tapi tetep aja, Allstate ninggalin, gimana dong? Hayo siapa yang tau solusi lain? Semoga ada yang lebih murah dan gak bikin kepala pusing kayak gini.

- Rising Claim Costs: Increased frequency and severity of claims due to factors like severe weather events (flooding, wildfires, hurricanes) or the rising cost of repairs can strain insurance companies’ profitability. This can lead to higher premiums, reduced coverage areas, or even a complete exit from high-risk regions.

- Changing Market Conditions: Competition from other insurers, shifts in consumer demand, and new regulations in the insurance sector can force companies to adapt their strategies. A company might choose to focus on areas with lower claim costs or higher profitability.

- Strategic Direction: Allstate may be adjusting its focus to concentrate on specific segments of the market or geographic regions where they see higher potential for growth and profitability. This can include a strategic withdrawal from areas with less attractive returns.

- Profitability and Business Strategy: The combination of rising claims, changing market dynamics, and strategic choices directly impacts a company’s bottom line. Areas with consistently high claim costs may no longer be profitable, leading to a company’s decision to withdraw.

- Examples of Similar Situations: Other insurers have faced similar challenges and have made similar decisions to reduce or eliminate coverage in certain regions. For instance, some companies have reduced coverage in areas prone to flooding or wildfires, opting to concentrate on areas with lower claim frequency.

| Insurer | Reason for Drop | Affected Area(s) | Timeframe |

|---|---|---|---|

| Allstate | (Hypothetical) Rising claim costs in coastal regions, reduced profitability | (Hypothetical) Coastal California, Florida panhandle | (Hypothetical) 2024-2025 |

| Competitor 1 (e.g., State Farm) | (Hypothetical) Increased competition, strategic shift | (Hypothetical) Some rural areas | (Hypothetical) 2022-2023 |

Impact on Customers, Allstate dropping homeowners insurance

The potential withdrawal of Allstate’s homeowners insurance could have significant consequences for its policyholders. Finding alternative coverage will be crucial for affected homeowners.

- Consequences for Homeowners: Homeowners currently insured by Allstate might face higher premiums with other insurers or difficulty finding alternative coverage, especially in the affected areas. This could be a significant issue for homeowners with limited options.

- Alternative Options: Homeowners need to explore options like contacting other insurance providers, using insurance brokers, and utilizing online comparison tools to find suitable coverage.

- Policy Comparison: A comparison of Allstate’s policies with other insurers should focus on coverage details, premium rates, and customer reviews to find the best fit.

| Insurer | Coverage Area | Premium Rates | Customer Reviews |

|---|---|---|---|

| Allstate | (Hypothetical) Nationwide | (Hypothetical) Varies by location | (Hypothetical) Mixed reviews, some complaints about high premiums |

| Competitor 1 | (Hypothetical) Nationwide | (Hypothetical) Varies by location | (Hypothetical) Positive reviews on affordability and customer service |

Financial Implications

Allstate’s decision has implications for both the company and its customers, potentially impacting premiums and market dynamics.

- Financial Implications for Allstate: A withdrawal from certain areas might be a calculated risk to maintain profitability, potentially focusing on more stable markets. The company might shift resources to other product lines.

- Impact on Premiums and Availability: The removal of Allstate from the market could lead to an increase in premiums for homeowners in affected areas as competition decreases.

- Market Shifts: The market might see a shift in competition, potentially benefiting some insurers and impacting others.

- Potential Benefits/Drawbacks for Insurance Industry: This could result in a more concentrated market, impacting consumer choices and competition. It might also prompt innovation and adjustments in the industry to better address risk.

Customer Reactions and Solutions

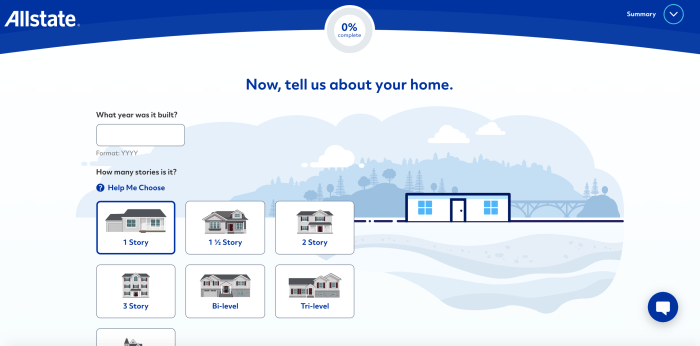

Source: insuranceproviders.com

Homeowners might react with concern or frustration, particularly if they find it difficult to secure alternative coverage. Finding suitable alternatives is crucial.

- Customer Reactions: Customers may express concern about coverage gaps and potential increases in premiums. They may experience frustration with the transition process.

- Insurance Coverage Gaps: Customers need to be aware of the possibility of coverage gaps and proactively seek solutions.

- Solutions to Find Alternatives: Consulting an insurance broker, comparing quotes online, and actively seeking alternative providers are crucial steps.

- Examples of Handling Similar Situations: Other insurance companies might offer temporary solutions or work with brokers to ensure a smooth transition for customers.

| Solution | Description | Pros | Cons |

|---|---|---|---|

| Insurance Brokerage | Working with an independent broker who can compare policies from various insurers | Expert advice, personalized recommendations | Potential fees, potential bias |

| Online Quotes | Using online comparison tools to get quotes from multiple insurers | Easy access, quick comparison | Might not be as personalized, accuracy of information |

Market Trends and Analysis

Several factors are driving trends in homeowners insurance, impacting the overall market.

- Market Trends: Factors such as increasing climate-related disasters, economic fluctuations, and regulatory changes affect homeowners insurance markets.

- Driving Factors: The rising frequency and severity of weather events are key factors. Economic conditions also play a significant role in pricing and demand.

- Comparison with Broader Market Trends: Allstate’s actions should be viewed within the broader context of these market trends, highlighting the need for companies to adapt.

- Key Takeaways from Market Research: Market research highlights the need for insurers to adapt to changing conditions, including weather patterns and consumer expectations.

Ultimate Conclusion

Source: homeowner.com

Allstate dropping homeowners insurance signals a significant shift in the market, leaving homeowners with uncertainties and the insurance industry grappling with new realities. The potential consequences for customers, the alternatives available, and the wider financial implications are all elements of a complex puzzle. This discussion has revealed the fragility of the insurance system, the ever-shifting tides of the market, and the urgent need for homeowners to explore alternative coverage options.

Will the insurance landscape remain stable, or will this be the first domino to fall in a cascade of change?