Pet best insurance coverage is a must-have for every pet owner, especially if you want to make sure your furry friend is well-protected. This guide provides a comprehensive look at different insurance options, covering everything from accident/sickness plans to wellness care. We’ll delve into the specifics, helping you understand what to look for when choosing the right plan for your pet.

From factors that affect costs to claim procedures, we’ll walk you through it all.

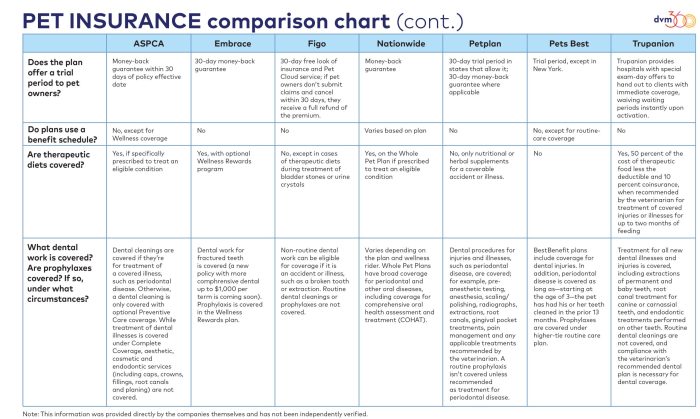

We’ll compare various providers, examining their strengths and weaknesses. We’ll also look at the coverage for specific conditions, like hip dysplasia or cancer. Furthermore, we’ll discuss preventive care and wellness plans, showing how proactive care can benefit your pet’s health and your wallet. Prepare to be amazed by the variety of plans available and discover the perfect match for your beloved companion.

Pet Insurance Coverage Types

Pet insurance offers various coverage options, catering to different needs and budgets. Understanding the nuances of each type is crucial for making an informed decision.

Coverage Options Comparison

Pet insurance plans typically fall into three main categories: accident/sickness, accident-only, and wellness plans. Accident/sickness plans provide the broadest coverage, encompassing both accidents and illnesses. Accident-only plans, as the name suggests, cover only accidents. Wellness plans focus on preventative care and routine checkups, often offering discounted services and early intervention opportunities.

Finding the best pet insurance coverage can feel overwhelming, but it’s a crucial investment for your furry friend’s well-being. Understanding your options is key, and researching reputable providers like Osualdo Torres with Allstate Insurance can be incredibly helpful. Osualdo Torres Allstate Insurance offers a range of plans, and comparing their coverage with other options can help you choose the best fit for your pet’s needs.

Ultimately, the right pet insurance coverage will provide peace of mind and financial security should your pet require veterinary care.

- Accident/Sickness: Provides comprehensive coverage for a wide range of illnesses and injuries. This is the most common type and generally offers the most protection.

- Accident-Only: Offers coverage only for accidents, excluding illnesses. This option might be more budget-friendly for pets with a lower risk of illness.

- Wellness: Concentrates on preventative care, including vaccinations, checkups, and wellness visits. This type may not cover serious illnesses or injuries, but it can help maintain a pet’s health.

Factors Influencing Plan Choice

Choosing the right pet insurance plan involves considering several factors. A pet’s age, breed, and health history are key considerations. Younger, healthier pets may require less comprehensive coverage than older or predisposed breeds.

- Pet’s Age: Younger pets generally have lower risks of pre-existing conditions and may require less comprehensive coverage.

- Breed: Certain breeds are predisposed to specific health issues. A plan tailored to the breed’s common health problems might be necessary.

- Health History: Pre-existing conditions can significantly impact the cost and coverage of a plan. Policies may exclude or limit coverage for pre-existing conditions.

Coverage Type Comparison Table

| Coverage Type | Covered Conditions | Exclusions | Approximate Cost |

|---|---|---|---|

| Accident/Sickness | Accidents, illnesses, injuries | Pre-existing conditions (may vary by policy), routine dental care (may vary by policy), some elective procedures | $50-$200+ per month |

| Accident-Only | Accidents | Illnesses, injuries, pre-existing conditions, routine dental care, elective procedures | $25-$100+ per month |

| Wellness | Vaccinations, routine checkups, wellness visits | Serious illnesses, injuries, pre-existing conditions, elective procedures | $10-$50+ per month |

Factors Influencing Insurance Costs: Pet Best Insurance Coverage

Pet insurance premiums are influenced by a variety of factors, impacting the overall cost of coverage.

Impact of Breed, Age, and Location

Breed, age, and location significantly influence insurance costs. Certain breeds are genetically predisposed to specific illnesses, which increases the risk pool and, consequently, the premium. Older pets often have a higher chance of developing health issues, leading to higher premiums. Geographic location can also impact costs due to variations in veterinary care costs and healthcare access.

Pricing Models and Cost Estimation, Pet best insurance coverage

Source: altaranchopet.com

Insurance providers employ various pricing models. Some providers consider breed-specific risk factors, while others adjust premiums based on age or location. A prospective policyholder can estimate potential costs by consulting available online calculators and contacting insurance providers directly for personalized quotes.

Understanding Pet Insurance Policies

Understanding policy terms and conditions is crucial for effective management of claims and expenses.

Key Terms and Conditions

Source: yourbestdigs.com

Common terms in pet insurance policies include deductibles, copays, and reimbursement rates. A deductible is the amount the policyholder must pay out-of-pocket before the insurance company starts covering costs. A copay is a fixed amount paid for each service. Reimbursement rates specify the percentage of expenses the insurance company will cover.

Impact on Claim Costs

Deductibles, copays, and reimbursement rates directly impact the overall cost of a claim. A higher deductible means a larger out-of-pocket expense for the policyholder before insurance kicks in. Lower reimbursement rates mean a smaller portion of the claim will be covered.

Preventive Care and Routine Checkups

Policies vary in their handling of preventative care and routine checkups. Some plans may cover routine vaccinations and wellness visits, while others may only cover them under specific circumstances or not at all.

Policy Terms Table

| Term | Definition | Impact on Cost |

|---|---|---|

| Deductible | Amount paid out-of-pocket before insurance coverage begins | Higher deductible = higher out-of-pocket costs initially |

| Copay | Fixed amount paid for each service | Copay amount affects the cost of each visit |

| Reimbursement | Percentage of expenses covered by insurance | Lower reimbursement rate = lower coverage amount |

Outcome Summary

In conclusion, understanding pet best insurance coverage is crucial for responsible pet ownership. We’ve explored the different types of plans, the factors influencing costs, and the claim process, arming you with the knowledge to make informed decisions. This guide has provided a comprehensive overview, ensuring you can confidently choose the best insurance for your furry friend. Remember, a well-protected pet is a happy pet, and you are now well-equipped to make the right choice.