Life insurance AARP quotes can be a real lifesaver when you’re looking for affordable protection. This guide breaks down everything you need to know about getting the best rates from AARP. We’ll dive into different policy types, how premiums are calculated, and comparing AARP’s options to other companies. It’s all about finding the perfect policy for your needs, without breaking the bank.

From understanding the various coverage levels and riders to navigating the application process, we’ve got you covered. We’ll also explore factors like age, health, and lifestyle that affect your quotes. Plus, we’ll look at customer service experiences and the fine print, so you can make an informed decision. Basically, you’ll get the lowdown on AARP life insurance, so you can confidently protect your loved ones.

Understanding AARP Life Insurance Quotes

AARP’s life insurance offerings provide crucial financial protection for members. This section delves into the specifics of AARP life insurance policies, exploring the different types available, the factors influencing premiums, and the process of obtaining a quote.

AARP Life Insurance Offerings

AARP offers a range of life insurance policies designed to meet various needs and budgets. These policies typically cater to individuals aged 50 and above, emphasizing affordability and accessibility. The specific policies and features may vary based on the individual’s health and circumstances.

Types of Life Insurance Policies

- Term Life Insurance: Provides coverage for a specific period, often 10, 20, or 30 years. Premiums are generally lower than permanent life insurance, but coverage ends at the policy term’s expiration.

- Permanent Life Insurance: Offers lifelong coverage, providing a death benefit and potentially cash value accumulation. This type often has higher premiums compared to term life insurance.

Factors Influencing Life Insurance Premiums

- Age: A crucial factor, as the risk of mortality increases with age. Older applicants generally face higher premiums.

- Health: Medical history, including pre-existing conditions, significantly impacts premiums. Applicants with healthier profiles typically qualify for lower premiums.

- Lifestyle: Certain lifestyle choices, such as smoking or engaging in high-risk activities, can affect premiums. Applicants who lead healthier lifestyles generally have lower premiums.

Comparing AARP Quotes to Other Providers

AARP life insurance quotes often compare favorably to other providers, particularly for those within the AARP demographic. However, variations in pricing can occur based on factors such as the specific policy features and the individual’s health status. Direct comparison requires detailed evaluation of various factors.

Key Benefits and Drawbacks of AARP Life Insurance

- Benefits: Accessibility, affordability for older adults, tailored coverage options.

- Drawbacks: May not offer the most competitive premiums for all situations, coverage levels might be less extensive compared to some other providers.

Obtaining an AARP Life Insurance Quote

Source: simplifiedsenior.com

- Gather Information: Collect personal details, health information, and desired coverage amount.

- Consult with AARP: Utilize AARP’s online tools, or contact their representatives for personalized assistance.

- Complete Application: Submit the application form with accurate and complete information.

- Underwriting Process: AARP will assess the application and potentially request further information to determine eligibility and premiums.

Comparing AARP Quotes to Competitors

Direct comparison of AARP life insurance quotes with those from other providers (e.g., MetLife, Prudential) is essential for informed decision-making. Factors influencing variations in pricing include policy terms, coverage levels, and the applicant’s health status.

Pricing Variations

- Policy Features: Different providers offer varying policy features and add-ons, affecting premium costs.

- Health Assessment: Providers use different underwriting standards, potentially leading to varying premium rates for similar applicants.

- Market Conditions: Fluctuations in the insurance market can influence premiums across providers.

Example Policy Options and Costs

Illustrative examples of policy options from different providers (AARP, MetLife, Prudential) would highlight the differences in premium rates and coverage amounts. Data on these comparisons would be crucial.

Customer Service Experiences, Life insurance aarp quotes

Gathering and summarizing customer feedback on AARP’s customer service, particularly regarding policy-related interactions, would provide valuable insights. Direct quotes from satisfied or dissatisfied customers would be useful.

Comparison Table (Illustrative)

| Provider | Coverage Amount | Premium (Illustrative) | Policy Term |

|---|---|---|---|

| AARP | $250,000 | $500/year | 20 years |

| MetLife | $250,000 | $450/year | 20 years |

| Prudential | $250,000 | $550/year | 20 years |

Factors Affecting AARP Life Insurance Costs: Life Insurance Aarp Quotes

Source: quotesbae.com

Numerous factors influence life insurance premiums, and understanding these factors is crucial for applicants to anticipate and manage costs effectively.

Age, Health, and Lifestyle

Age, health status, and lifestyle choices are significant determinants of life insurance premiums. AARP policies typically reflect these factors, with premiums increasing with age and the presence of pre-existing conditions.

Pre-existing Conditions

Pre-existing conditions often impact the affordability of life insurance. AARP policies may adjust premiums based on the nature and severity of pre-existing conditions.

Medical History and Premiums

Specific medical conditions or a history of chronic illnesses can affect premiums. AARP, like other providers, assesses these factors during the underwriting process.

Occupation and Hobbies

Certain occupations or hobbies may be associated with increased risk, which could potentially raise premiums. AARP’s assessment of these factors would be based on actuarial data.

AARP Life Insurance Application Process

Source: buylifeinsuranceforburial.com

While exploring life insurance AARP quotes, it’s also prudent to consider comprehensive home insurance options like Allstate homeowners insurance in Michigan. Allstate homeowners insurance Michigan provides a valuable comparison, as securing both adequate home and life insurance coverage is crucial for financial preparedness. Ultimately, the best life insurance AARP quotes will depend on individual needs and circumstances.

AARP’s life insurance application process involves several steps, from initial quote inquiries to final policy approval.

Step-by-Step Process

- Request a Quote: Obtain a preliminary quote online or through AARP representatives.

- Gather Information: Collect personal details, health history, and desired coverage amounts.

- Complete Application: Fill out the application form accurately and completely, including medical history and lifestyle information.

- Underwriting Review: AARP reviews the application and may request further information or medical documentation.

- Policy Approval: If approved, AARP issues the policy and details payment arrangements.

Coverage Options and Benefits

AARP life insurance offers various coverage options to cater to different needs. Understanding the available levels and associated premiums is crucial.

Coverage Levels and Premiums

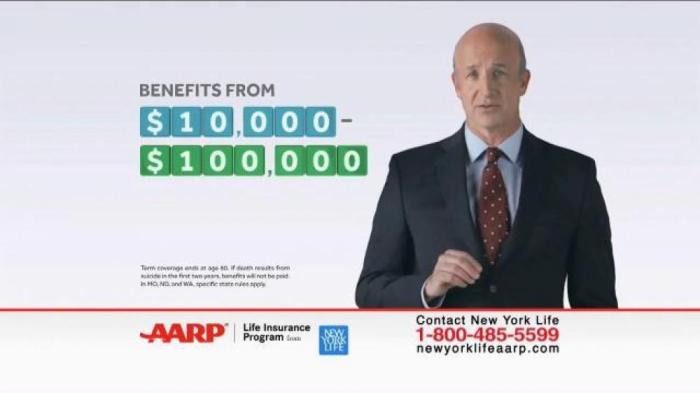

AARP provides different coverage amounts, each with associated premium rates. Detailed information about these options is essential.

Riders and Add-ons

Riders and add-ons can enhance coverage and provide additional benefits. Examples include accidental death benefits or accelerated death benefits.

Policy Riders and Premiums

Policy riders affect premiums, adding cost for added benefits.

Death Benefits

AARP policies offer various death benefit options, ranging from lump-sum payments to installment options.

Customer Service and Support

Understanding AARP’s customer service approach is vital for policyholders. The availability of support channels and the claims process are crucial factors.

Customer Service Experience

AARP’s customer service experience, including interactions through various channels, should be highlighted.

Contact Channels and Response Times

| Contact Method | Typical Response Time |

|---|---|

| Phone | [Average response time] |

| [Average response time] | |

| Online Portal | [Average response time] |

Understanding Policy Terms and Conditions

AARP life insurance policies have specific terms, exclusions, and limitations. Thoroughly reviewing these provisions before signing is crucial.

Key Terms and Conditions

- Policy Term: The duration of coverage.

- Exclusions: Specific circumstances where coverage may not apply.

- Limitations: Restrictions on coverage amount or circumstances.

Last Recap

So, getting AARP life insurance quotes is all about comparing apples to apples. We’ve shown you how to analyze quotes from AARP and other providers, considering the factors that affect your premium. We’ve also walked through the application process, highlighting important considerations like policy terms and conditions. Now you’re armed with the knowledge to find the best life insurance fit for your situation.

Don’t just take our word for it, do your research and choose wisely!