Home and auto insurance quote comparison is crucial for savvy students. This guide delves into the process, from understanding policy nuances to utilising online tools. We’ll cover everything from comparing premiums to evaluating different coverage options. Ultimately, this info will help you bag the best deal, ensuring you’re properly covered without breaking the bank.

Comparing home and auto insurance quotes can be a real headache, right? But did you know that figuring out if pet insurance covers things like hip dysplasia is just as important? Knowing if policies like Pets Best Insurance cover a condition like hip dysplasia is crucial for pet owners. For example, if your furry friend is facing such a costly condition, does Pets Best Insurance cover hip dysplasia ?

Ultimately, thorough comparison shopping for home and auto insurance is key to finding the best deals.

Comparing quotes isn’t rocket science, but it’s more than just picking the cheapest option. Understanding factors influencing premiums, like your driving record or home’s features, is key. We’ll also dissect the jargon and highlight essential policy details to avoid nasty surprises down the line.

Introduction to Home and Auto Insurance Quote Comparison

Comparing home and auto insurance quotes is a crucial step in securing the best possible coverage at the most affordable price. This process involves evaluating different insurance providers, understanding policy terms, and selecting the most suitable options to meet your individual needs. By taking the time to compare quotes, you can potentially save money and ensure you have adequate protection for your assets.

Benefits of Comparing Quotes

- Cost Savings: Comparing quotes allows you to identify providers offering lower premiums without sacrificing essential coverage.

- Improved Coverage: Some providers offer more comprehensive coverage at a competitive price compared to others. Comparison helps you find a policy that best fits your risk profile.

Types of Home and Auto Insurance Policies

Source: nurpost.com

- Home Insurance: Policies typically cover dwelling, personal property, and liability. Specific options include flood insurance, earthquake insurance, and other add-ons.

- Auto Insurance: Common types include liability, collision, and comprehensive coverage. Policies may also include uninsured/underinsured motorist protection and roadside assistance.

Understanding Policy Terms and Conditions

Thorough review of policy terms and conditions is vital. This includes understanding deductibles, coverage limits, exclusions, and other stipulations to avoid any surprises or gaps in protection. Carefully examine any fine print or limitations in coverage.

Insurance Provider Comparison

| Company Name | Premium Cost (Example) | Coverage Details (Example) |

|---|---|---|

| Acme Insurance | $1,200 annually | Dwelling, personal property, liability, comprehensive auto |

| Reliable Insurance | $1,500 annually | Dwelling, personal property, liability, comprehensive auto, roadside assistance |

| Secure Insurance | $1,000 annually | Dwelling, personal property, liability, basic auto |

Online Comparison Tools and Resources

Online comparison tools streamline the quote comparison process, saving you time and effort. They provide a platform to compare various insurance options from different providers in one convenient location.

Reliable Online Comparison Websites, Home and auto insurance quote comparison

- Insurify

- Policygenius

- QuoteWizard

- NerdWallet

Features of Comparison Platforms

- Customizable Searches: You can tailor your search to specific needs and preferences.

- Multiple Quotes in One Place: This feature simplifies the process by allowing you to compare multiple quotes from various providers at once.

- Detailed Coverage Information: Detailed descriptions of policy options are usually available.

Comparison of Online Tools

| Tool | Pros | Cons |

|---|---|---|

| Insurify | User-friendly interface, quick results | Limited customization options |

| Policygenius | Extensive coverage options, excellent customer support | Slightly higher processing time |

| QuoteWizard | Wide range of providers, detailed coverage descriptions | Can be overwhelming for beginners |

Factors Influencing Insurance Premiums

Several factors influence the cost of home and auto insurance premiums. Understanding these factors helps you make informed decisions and potentially negotiate better rates.

Home Insurance Premium Factors

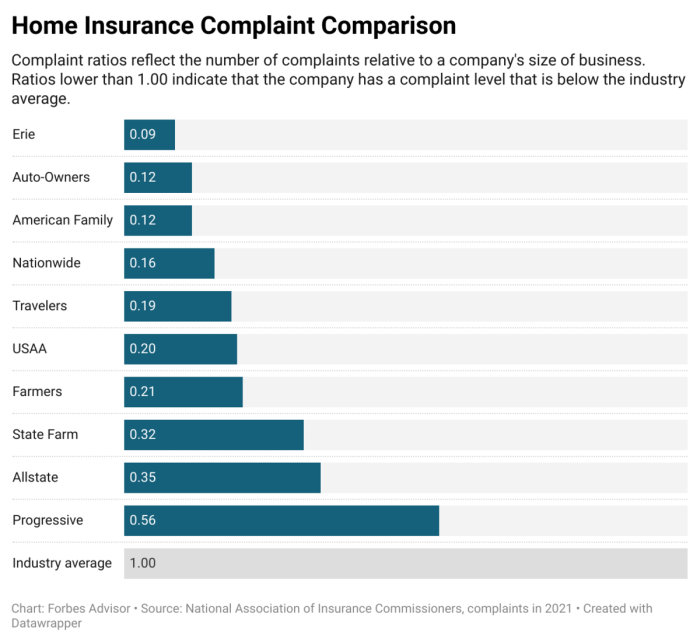

Source: forbes.com

- Location: Areas prone to natural disasters often have higher premiums.

- Home Value: Higher-value homes typically have higher premiums.

- Home Features: Security systems and fire-resistant materials can lower premiums.

Auto Insurance Premium Factors

- Driving Record: Accidents and traffic violations increase premiums.

- Vehicle Type: Certain vehicles, like sports cars, may have higher premiums.

- Location: High-accident areas or congested cities usually result in higher premiums.

Coverage Details and Policy Options

Understanding the different types of coverage is crucial for choosing the right policy. This section details the various options available for home and auto insurance.

Home Insurance Coverage

| Coverage Type | Description |

|---|---|

| Dwelling | Covers the structure of your home. |

| Personal Property | Covers your belongings inside the home. |

| Liability | Protects you from lawsuits arising from accidents on your property. |

Tips for a Successful Quote Comparison: Home And Auto Insurance Quote Comparison

Following these tips can help you find the best home and auto insurance policy for your needs.

- Gather Information: Collect information on various policies and providers.

- Understand Deductibles and Limits: Knowing these factors helps you make informed decisions.

- Negotiate: Don’t hesitate to negotiate premiums with providers.

Understanding the Insurance Contract

Understanding the terms and conditions of your insurance policy is vital to avoid future issues.

- Essential Elements: A policy typically Artikels coverage, exclusions, and limitations.

- Policy Clauses: These clauses detail the specifics of the policy.

- Limitations and Exclusions: These aspects limit the policy’s coverage scope.

Choosing the Right Policy

Selecting the right policy involves carefully considering your individual needs and risk assessment.

- Prioritize Coverage: Focus on coverage based on your specific needs.

- Review Policy Details: Thorough review is crucial to understand coverage limits and exclusions.

Wrap-Up

So, you’ve navigated the labyrinth of home and auto insurance quote comparison. Armed with this knowledge, you’re better equipped to make informed decisions, securing the right coverage for your needs at the best possible price. From comparing providers to understanding policy terms, this guide’s got you covered. Remember, thorough research and careful consideration are paramount for securing the most suitable policy.

Good luck!