Sell structured insurance settlements is a complex process requiring careful consideration of various factors. Navigating the intricacies of these settlements, from understanding their diverse payout structures to evaluating tax implications and legal frameworks, is crucial for both buyers and sellers. This guide provides a thorough overview, dissecting the process of selling a structured settlement, including potential risks and mitigation strategies.

The process encompasses understanding different settlement types, analyzing payout options, and meticulously considering the financial and legal aspects. A critical component involves assessing the market trends, regulatory oversight, and potential future developments to optimize the sale process. Thorough due diligence and a strategic approach are paramount for a successful outcome.

Understanding Structured Settlements

Structured settlements offer a unique approach to resolving insurance claims, providing a structured payment plan rather than a lump-sum payout. This method can be beneficial for both parties involved, offering potential advantages in managing financial resources and mitigating risk.

Various Forms and Structures

Structured settlements encompass various payment arrangements. They can involve periodic payments over a predetermined period, potentially extending to decades. These payments can be fixed or adjusted based on inflation or other factors. Common structures include lump-sum payments with future installments, or annuity-based payouts. These different forms cater to varying needs and financial circumstances.

Payout Options

- Fixed Periodic Payments: A predetermined amount is paid at regular intervals (e.g., monthly, quarterly). This provides predictable income.

- Inflation-Adjusted Payments: Payments are adjusted to account for inflation, ensuring purchasing power remains constant over time.

- Contingent Payments: Payments are contingent on specific events or milestones, offering flexibility based on future needs.

- Combination of Options: Settlements often incorporate a blend of these options to optimize outcomes for both parties.

Negotiating and Securing a Settlement

Negotiation involves detailed discussions between claimants and insurers. The process often involves legal representation to ensure fairness and protect the interests of the claimant. Factors influencing the structure include the severity of the claim, projected future costs, and the claimant’s financial needs.

Unlocking the financial freedom of structured insurance settlements is amazing! Imagine the possibilities – but securing the best possible coverage for your furry friend is equally important. Consider pets best dog insurance for comprehensive protection. These settlements are a fantastic way to maximize your financial gain while ensuring your beloved pet has the best care available.

With the right approach, structured settlements can be a game changer, giving you peace of mind and a secure financial future.

Common Settlement Structures

Examples include lump-sum payments with a portion allocated to future installments, or annuity-based structures with periodic payments guaranteed for a specific timeframe. Specific terms are negotiated to reflect the unique circumstances of each case.

Advantages and Disadvantages, Sell structured insurance settlements

| Feature | Structured Settlement | Lump-Sum Payout |

|---|---|---|

| Predictability of Income | High, due to scheduled payments | Low, unless invested |

| Tax Implications | Complex, potentially higher or lower than lump-sum | Generally simpler tax implications |

| Potential for Future Inflation | Can be mitigated with inflation adjustments | Exposure to inflation without adjustments |

| Financial Planning | Facilitates long-term financial planning | Requires immediate financial planning |

Tax Implications and Financial Planning

Source: annuityfreedom.net

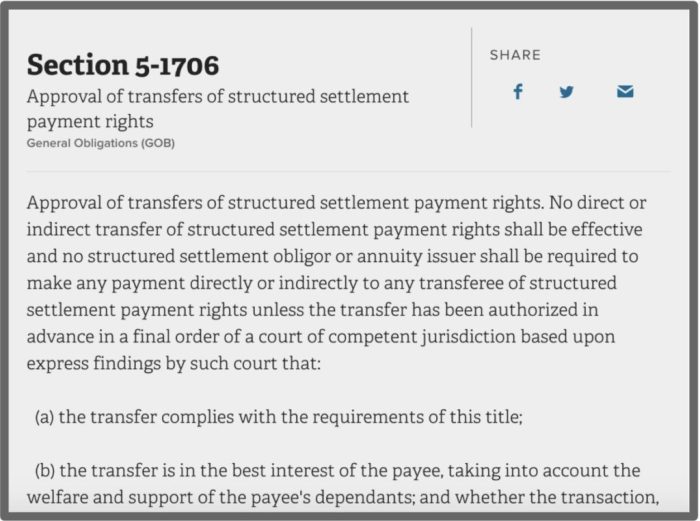

Understanding the tax implications of structured settlements is crucial for effective financial planning. Tax laws vary depending on the structure and jurisdiction. Proper planning is key to maximizing the value of these settlements over time.

Tax Implications

Structured settlements are often taxed as ordinary income, with the timing and manner of taxation varying based on the payment structure. Potential tax implications must be considered during settlement negotiations.

Long-Term Financial Planning

Structured settlements necessitate careful financial planning. Investors must consider the impact on their overall financial portfolio, and potential investment strategies should account for the unique characteristics of the settlement’s payout structure.

Risks and Challenges

Potential challenges include the complexities of tax reporting and long-term financial management. The timing and method of payout can also impact overall financial security. Careful consideration and guidance from financial professionals are recommended.

Tax Treatment Comparison

The tax treatment of structured settlements differs from other income streams. Understanding these differences is critical to making informed decisions regarding financial management.

Potential Tax Implications Table

Source: innewsweekly.com

| Settlement Structure | Tax Implications |

|---|---|

| Fixed Periodic Payments | Taxed as ordinary income each payment period |

| Inflation-Adjusted Payments | Taxed on the adjusted amount each payment period |

| Lump-Sum with Future Installments | Initial lump sum taxed as ordinary income, future installments also taxed as ordinary income |

Considerations for Buyers and Sellers: Sell Structured Insurance Settlements

Structured settlements offer unique considerations for both buyers and sellers. Buyers must assess the value and risk, while sellers need to consider the implications of structuring a payment plan. Legal and financial expertise are often crucial for both parties.

Buyer Considerations

- Valuation Factors: Factors such as the amount, frequency, and duration of payments affect the overall value of the settlement.

- Acquisition Process: The acquisition process often involves legal representation and due diligence.

- Long-Term Financial Implications: Careful planning is necessary to manage the potential financial impacts of the settlement.

Seller Considerations

- Structuring a Settlement: Considerations involve the best method for managing financial obligations, and aligning payment terms with future goals.

- Potential Tax Implications: Understanding potential tax implications is vital to making informed decisions.

- Financial Implications: Carefully evaluating the financial impact of structuring the settlement on the seller’s overall financial situation.

Buyer/Seller Considerations Table

| Factor | Buyer Considerations | Seller Considerations |

|---|---|---|

| Valuation | Assessment of payment structure, risk | Negotiating payment terms, risk |

| Legal Aspects | Due diligence, legal representation | Legal representation, compliance |

| Financial Planning | Long-term financial implications | Long-term financial implications |

Final Review

In conclusion, selling structured insurance settlements demands a multifaceted approach. Understanding the intricate details, including various payout options, tax implications, legal frameworks, and market trends, is essential. A strategic plan, encompassing risk mitigation strategies and a thorough understanding of the potential pitfalls, is vital. This guide offers a comprehensive roadmap for navigating the process, empowering both buyers and sellers to make informed decisions.

However, seeking professional advice is highly recommended for navigating the complexities of this field.