Allstate homeowners insurance Illinois offers a range of coverage options tailored to the specific needs of Illinois residents. This guide provides a detailed overview of Allstate’s policies, comparing them to competitors, and exploring key factors like coverage amounts, premiums, and claims processes. Understanding your options is crucial for making informed decisions about your home protection.

Navigating the complexities of Allstate homeowners insurance in Illinois can be challenging. Understanding your policy specifics and potential claims, especially if faced with a significant event like a truck accident, is crucial. If a trucking accident in Michigan has impacted your property, seeking legal counsel from a reputable michigan truck accident lawyer is vital to ensuring your rights are protected.

Ultimately, having a clear understanding of your insurance coverage, like Allstate homeowners insurance in Illinois, is essential for peace of mind in any situation.

From the core dwelling and personal property coverage to liability protections, we’ll explore the nuances of Allstate’s policies in Illinois. We’ll delve into various policy options, available discounts, and important considerations for choosing the right plan. This exploration will empower you with the knowledge needed to secure the best protection for your Illinois home.

Allstate Homeowners Insurance in Illinois

Allstate offers a comprehensive range of homeowners insurance policies in Illinois, designed to protect residents from various risks. This overview details the specifics of these policies, including coverage options, policy comparisons, claims processes, discounts, and regulatory information.

Overview of Allstate Homeowners Insurance in Illinois

Allstate’s Illinois homeowners insurance policies typically include coverage for the dwelling itself, personal property within the home, and liability for injuries or property damage caused by the policyholder.

- Dwelling Coverage: Protects the physical structure of the home against perils such as fire, windstorm, hail, and other covered events.

- Personal Property Coverage: Insures belongings within the home against loss or damage from covered perils.

- Liability Coverage: Protects the policyholder from financial responsibility if someone is injured or their property is damaged due to the policyholder’s actions or negligence.

Common policy exclusions may include flood, earthquake, and wear and tear. Premiums are influenced by factors such as home value, location, and claims history.

Compared to other major insurers in Illinois, Allstate’s policies offer a range of coverage options, with premiums varying based on individual circumstances. Factors influencing premiums, beyond the aforementioned ones, include the specific coverage limits selected and any available discounts.

Policy Comparison and Options

Source: futurecdn.net

| Feature | Allstate | State Farm | Farmers |

|---|---|---|---|

| Dwelling Coverage | $250,000 – $500,000+ | $200,000 – $400,000+ | $225,000 – $450,000+ |

| Personal Property Coverage | $50,000 – $100,000+ | $40,000 – $80,000+ | $45,000 – $90,000+ |

| Liability Coverage | $300,000 – $500,000+ | $300,000 – $500,000+ | $250,000 – $400,000+ |

| Premium (example) | $1,200 – $2,500+ | $1,100 – $2,200+ | $1,150 – $2,300+ |

| Deductible | $500 – $1,000 | $500 – $1,000 | $500 – $1,000 |

Policy options include add-on coverages like flood, earthquake, or replacement cost coverage, as well as various endorsements. Different levels of coverage for dwelling, personal property, and liability are available, allowing policyholders to customize their protection.

Claims and Customer Service

Allstate’s claims process typically involves reporting the loss, providing documentation, and cooperating with Allstate adjusters. The customer service options include phone, online portal, and in-person assistance. Response times and resolution procedures vary based on claim complexity and available resources.

Discounts and Savings

Source: cloudinary.com

Allstate offers various discounts, such as multi-policy discounts, bundled discounts, and discounts for safety devices like smoke detectors. These discounts can significantly reduce premiums. Comparisons with other insurers reveal varying discount structures.

Coverage Examples and Scenarios

| Scenario | Potential Payout | Coverage Limitations |

|---|---|---|

| Fire Damage | Based on policy limits and damage assessment | Exclusions for certain causes, or wear and tear. |

| Theft | Based on policy limits and inventory | Exclusions for certain types of items or situations. |

A scenario of a covered loss involving water damage would involve reporting the incident, providing necessary documentation, and working with an adjuster to assess the damage and the corresponding payout.

Policy Documents and Resources, Allstate homeowners insurance illinois

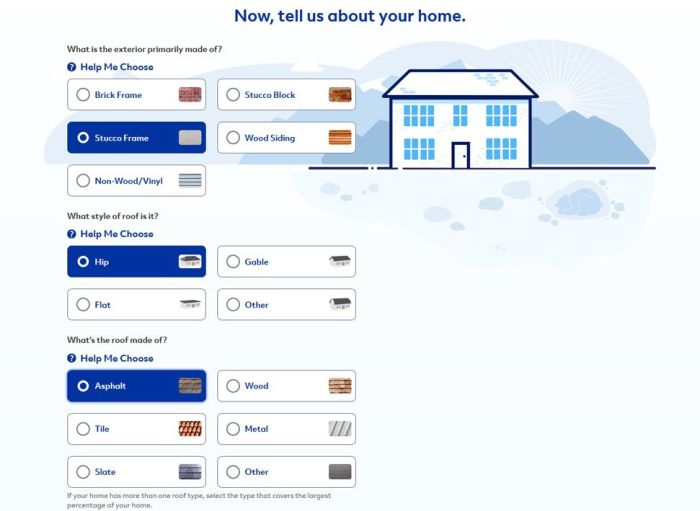

Source: insurancegeek.com

Essential policy documents include the policy certificate, declarations page, and endorsements. Policyholders can access these documents online or through customer service. Additional resources, like FAQs and claim forms, are available to assist policyholders.

Regulatory Information and Consumer Protection

The Illinois Department of Insurance oversees homeowners insurance in the state, ensuring compliance with relevant laws and regulations. Policyholders have specific rights and can utilize complaint procedures if they have concerns about Allstate’s practices.

End of Discussion: Allstate Homeowners Insurance Illinois

In conclusion, navigating Allstate homeowners insurance in Illinois involves understanding the various policy types, coverage scenarios, and available discounts. By comparing Allstate’s offerings to competitors and examining the claim process, policyholders can make informed decisions. Ultimately, this comprehensive guide provides a robust foundation for protecting your Illinois home with the most suitable insurance plan.