Car insurance quotes set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a focus on finding the best coverage effortlessly. From the importance of comparing quotes to the factors affecting them, this guide delves into the world of car insurance with clarity and precision.

As we explore the significance of personalized quotes, delve into the key factors influencing quotes, and unravel the various types of coverage available, readers are in for an informative ride through the realm of car insurance quotes.

Importance of Car Insurance Quotes

When it comes to securing your vehicle and financial well-being, car insurance is a must-have. However, not all insurance policies are created equal, which is why obtaining car insurance quotes is crucial in finding the best coverage that suits your needs.

Comparing Car Insurance Quotes

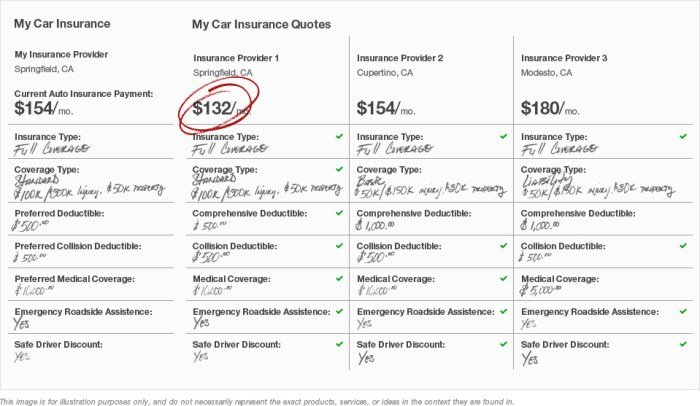

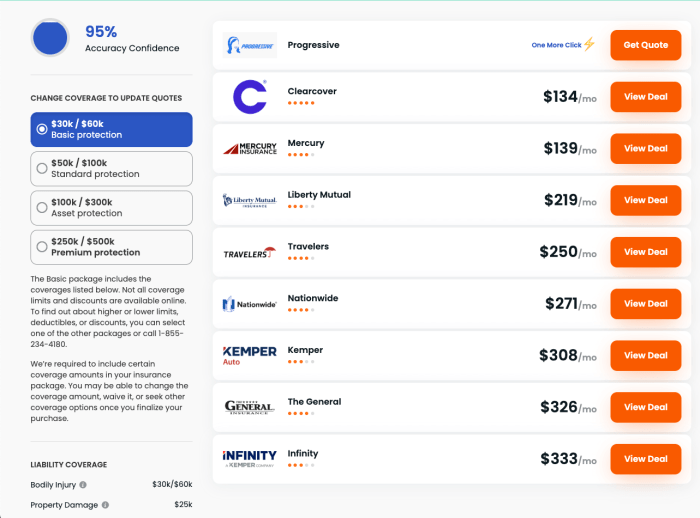

- Comparing car insurance quotes allows you to evaluate different coverage options from various insurance providers, helping you make an informed decision.

- By comparing quotes, you can identify cost-effective policies that offer comprehensive coverage, ensuring you get the most value for your money.

- Additionally, comparing quotes can help you uncover discounts and special offers that may not be apparent if you only stick with one insurance provider.

Saving Money with Multiple Quotes

- Obtaining multiple car insurance quotes gives you a clear picture of the pricing range in the market, enabling you to negotiate better rates with your preferred insurer.

- Insurance providers may offer competitive rates or discounts to match or beat their competitors, allowing you to secure affordable coverage without compromising on quality.

- By shopping around and comparing quotes, you can potentially save hundreds of dollars annually on your car insurance premiums.

Personalized Quotes for Individual Needs

- Getting personalized car insurance quotes tailored to your specific needs and circumstances ensures that you receive adequate coverage without paying for unnecessary add-ons.

- Insurance providers take into account factors such as your driving history, vehicle type, and location to offer customized quotes that align with your unique requirements.

- Personalized quotes help you avoid overpaying for coverage you don’t need while ensuring you have the right protection in place for unforeseen events.

Factors Affecting Car Insurance Quotes

When it comes to determining car insurance quotes, several factors come into play that can influence the cost of coverage. It is essential to understand these factors to make informed decisions when selecting an insurance policy.Age, Driving Record, Vehicle Type, and Location:

Age:

Younger drivers, especially teenagers, typically face higher insurance premiums due to their lack of experience on the road. On the other hand, older drivers may enjoy lower rates as they are considered more experienced and less risky.

Driving Record:

A clean driving record with no accidents or traffic violations usually results in lower insurance premiums. However, a history of accidents or speeding tickets can lead to higher rates as it indicates a higher risk of future claims.

Vehicle Type:

The make and model of the vehicle you drive can impact your insurance quotes. Sports cars and luxury vehicles tend to have higher premiums due to their higher repair costs and increased likelihood of theft.

Location:

Your location plays a significant role in determining your car insurance rates. Urban areas with higher rates of accidents and theft may result in higher premiums compared to rural areas with lower risks.Coverage Options and Deductibles:When selecting coverage options and deductibles for your insurance policy, you can customize your premium based on your needs and budget. Opting for comprehensive coverage or low deductibles will increase your premium, while choosing basic coverage or higher deductibles can lower your costs.Credit Score, Mileage Driven, and Previous Claims History:

Credit Score:

Insurance companies may use your credit score as a factor in determining your insurance premium. A higher credit score is often associated with lower rates, as it suggests financial responsibility and lower risk.

Mileage Driven:

The number of miles you drive annually can impact your insurance quotes. Higher mileage increases the risk of accidents, leading to higher premiums. Conversely, low mileage drivers may be eligible for discounts.

Previous Claims History:

Your history of filing insurance claims can affect your premium. If you have a record of frequent claims, insurers may consider you a higher risk and charge higher rates. Maintaining a clean claims history can help keep your premiums affordable.

Types of Coverage in Car Insurance Quotes

When getting car insurance quotes, it’s essential to understand the different types of coverage included. Each type offers specific benefits and limitations, tailored to different situations and needs.

1. Liability Coverage

Liability coverage is required in most states and helps cover costs if you’re at fault in an accident that causes injuries or property damage to others. This type of coverage typically includes bodily injury liability and property damage liability.

2. Comprehensive Coverage, Car insurance quotes

Comprehensive coverage protects your vehicle from non-collision damages, such as theft, vandalism, fire, or natural disasters. It’s optional but can provide valuable protection for your car.

3. Collision Coverage

Collision coverage helps pay for repairs to your vehicle if you’re involved in a collision with another vehicle or object. This coverage is also optional but can be beneficial, especially for newer or more expensive cars.

4. Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re in an accident with a driver who doesn’t have insurance or enough insurance to cover the damages. It can help pay for medical expenses and vehicle repairs in such situations.By understanding the benefits and limitations of each type of coverage, you can make informed decisions when choosing the right car insurance policy for your needs.

Tips for Getting Accurate Car Insurance Quotes

When obtaining car insurance quotes, it is crucial to ensure the accuracy of the information provided. Inaccurate details can lead to misleading quotes and potential issues in the future. Here are some tips to help you get accurate car insurance quotes:

Update Information Regularly

It is important to update your information regularly to reflect any changes that may impact the premium. This includes updates on your driving record, vehicle details, and any other relevant information that could affect the cost of your insurance.

- Regularly update your address, driving history, and vehicle details to ensure accurate pricing.

- Any changes in your circumstances, such as moving to a new location or adding a new driver, should be promptly communicated to your insurance provider.

Avoid Common Mistakes

There are common mistakes that can result in inaccurate insurance quotes. By being aware of these pitfalls, you can avoid unnecessary discrepancies in your car insurance pricing.

- Providing incorrect information about your driving history or vehicle details can lead to inaccurate quotes.

- Failure to disclose all relevant information, such as past accidents or traffic violations, can impact the accuracy of your insurance quotes.

- Comparing quotes without ensuring that the coverage and deductibles are the same across different providers can result in misleading price comparisons.

Final Conclusion

In conclusion, car insurance quotes serve as the cornerstone for securing the ideal coverage tailored to individual needs. By understanding the intricacies of quotes and the factors shaping them, one can navigate the insurance landscape with confidence and clarity. Stay informed, stay protected.

Popular Questions

What factors can influence car insurance quotes?

Factors such as age, driving record, vehicle type, location, credit score, mileage driven, and previous claims history can all impact the cost of insurance quotes.

How can I ensure the accuracy of the information provided for insurance quotes?

To ensure accuracy, double-check all details provided, update information regularly to reflect any changes, and avoid common mistakes that could lead to inaccurate quotes.

What are the different types of coverage included in car insurance quotes?

Car insurance quotes typically include liability, comprehensive, collision, and uninsured motorist coverage. Each type offers different benefits and limitations, catering to varying needs and circumstances.

Why is comparing car insurance quotes important?

Comparing quotes is crucial for finding the best coverage at the most competitive rates. It helps in saving money and ensures that individuals get personalized quotes that meet their specific requirements.